30+ paying mortgage every 2 weeks

The general rule is that if you double your required payment you will pay your 30-year fixed rate loan off in less than ten years. Web By making payments every two weeks youll make 26 payments per year instead of 12.

3 Biweekly Mortgage Templates In Pdf

Biweekly payment methods can position a homeowner to pay off a mortgage loan.

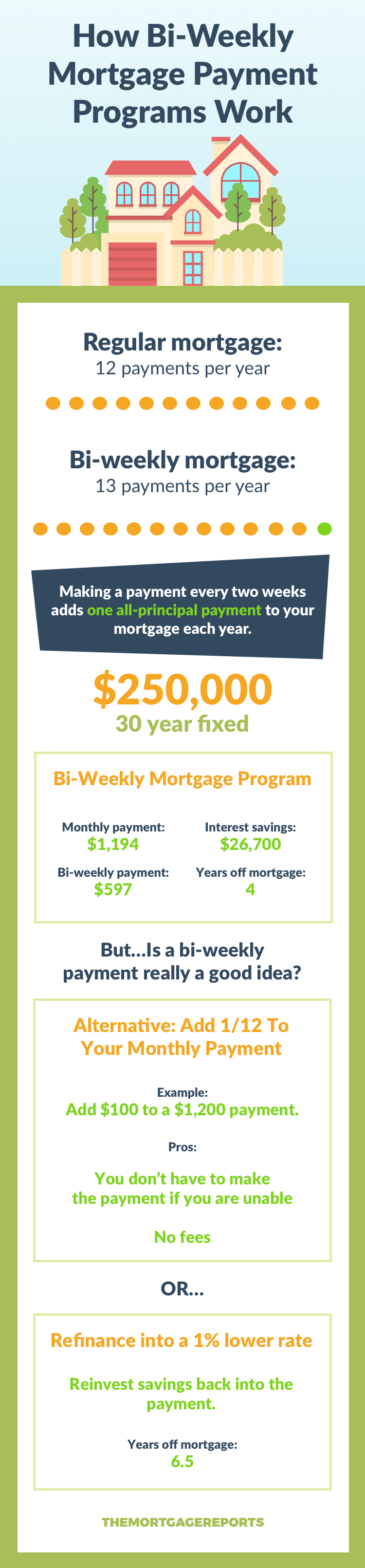

. The practice is called bi-weekly mortgage payments a strategy where mortgage loan customers pay their mortgage loan every two weeks instead of once a month. Simply by performing the steps of switching to biweekly payments and directing an additional 50 monthly to your mortgage you can reduce its length from 30 years to 23 years and eight months. Web For example if you have a 30-year 250000 mortgage at a 5 percent interest rate you will pay 134205 per month not counting property taxes and insurance.

It can be a good option for those wanting to contribute more money toward a mortgage without. Paying half of your regular monthly mortgage payment every two weeks will result in an interest cost of 97215 saving you 30329. If you paid biweekly your payment would be 71612 143225 2 every two weeks.

Web Borrowers frequently synchronize their biweekly payments with payroll periods that occur every two weeks. With the bi-weekly mortgage plan each year one additional mortgage payment is made. Web With this payment method you pay 382 half your monthly payment every two weeks.

Your monthly payment would be 143225 and your balance would be paid off in 30 years. Web If your lender allows biweekly payments and applies the extra payments directly to your principal you can simply send half your mortgage payment every two weeks. Web One way to pay off your mortgage early is by making larger monthly payments.

Over the course of a year you will make 26 payments of 35076 totalling 9120 whereas with 12 standard monthly payments you would pay only 8418. If you make biweekly payments for the life of the loan once your mortgage is paid off youll have paid a total of 256288 on the loan and youll pay off your mortgage in 25 years and nine months cutting 4 years and 3 months of payments off. For example if you pay 1200 once per month as your entire monthly mortgage payment youre currently making monthly mortgage payments of.

Web With biweekly mortgage payments you make 26 half-payments a year which equates to 13 total payments in a year. Web A biweekly mortgage payment plan involves making half of that mortgage payment or 104750 every two weeks for a total of 26 payments each year. Web For example a fixed-rate mortgage of 120000 at 5 interest over 25 years will require a monthly repayment of 70151.

You would pay 23313946 in interest over the life of the loan making the standard monthly payments. Web Homeowners looking to cut their overall mortgage debt can get the job done more quickly by paying their mortgage every other week. Web If you have a 300000 mortgage at 4 for 30 years biweekly payments will save you 35000 in interest payments.

What happens if I pay an extra 200 a month on my mortgage. NerdWallets early mortgage payoff calculator figures it out for you. A 100000 mortgage with a 6 percent interest rate requires a payment of 59955 for 30 years.

Web Assuming a 100000 30-year mortgage at a fixed interest rate of 65 youll pay 127544 in interest plus the 100000 principal for a total of 227544. A bi-weekly payment would be half of that 35076. While each payment is equal to half the monthly amount you end up paying an extra month per year with this method.

Web Even an additional 25 paid biweekly can reduce the length of your mortgage by almost two years. But how much more should you pay. Web Zeibert gives the example of a 30-year fixed loan of 250000 at a 4 interest rate.

Web Tens of thousands of dollars can be saved by making bi-weekly mortgage payments and enables the homeowner to pay off the mortgage almost eight years early with a savings of 23 of 30 of total interest costs. Web How many years does 2 extra mortgage payments take off. Consider a 300000 mortgage at a 4 percent interest rate for 30 years.

Biweekly payments would save a borrower nearly 30000 in interest charges and have the loan paid off in. Web This will result in paying down your mortgage faster. If you have a 200000 mortgage at 3 for 30 years biweekly payments.

If your monthly payment is 2000 for instance you can send 1000 biweekly. At that rate by the end of the.

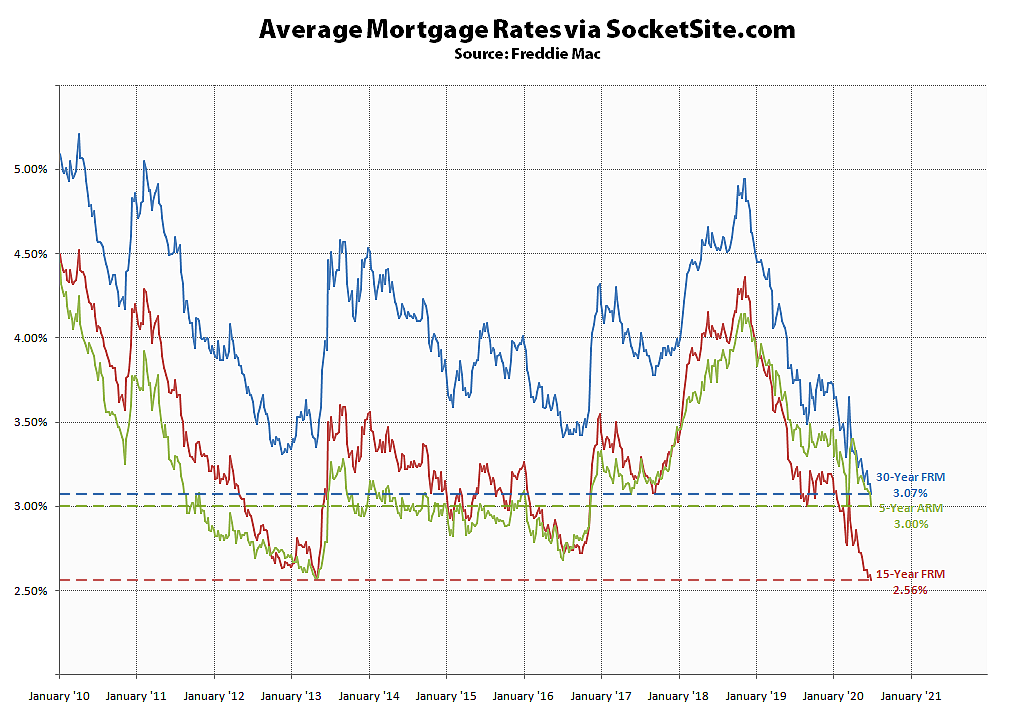

Bank Of Canada Rate Hike Pushed Many Mortgage Borrowers Above Stress Test Bmo Better Dwelling

Benchmark Mortgage Rate Nearing An Unprecedented Mark

How Much Do Biweekly Payments Shorten A 30 Year Mortgage Budgeting Money The Nest

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Bi Weekly Mortgage Program Are They Even Worth It

30 Mortgage Loan Officer Illustrations Royalty Free Vector Graphics Clip Art Istock Partnership House For Sale House Exterior

Create A Loan Amortization Schedule In Excel With Extra Payments

Excel Ppmt Function With Formula Examples

How Much Do Biweekly Payments Shorten A 30 Year Mortgage Budgeting Money The Nest

Bi Weekly Payment Calculator Franklin Mortgage Co

Biweekly Vs Monthly Mortgage Payments What To Know Chase

Biweekly Mortgage Calculator Pay Off Your Home Loan Fast Using Bi Weekly Vs Monthly Payments

Mortgagerate Explore Facebook

Will A Weekly Bimonthly Or Biweekly Payment Mortgage Really Save Me Money

Biweekly Payments Mortgage Calculator Nerdwallet

Biweekly Vs Monthly Mortgage Payments What To Know Chase

Bi Weekly Mortgage Payment Savings Biweekly Mortgage Amortization Program